Unduh Aplikasi

-

- Platform Perdagangan

- Aplikasi PU Prime

- MetaTrader 5

- MetaTrader 4

- PU Copy Trading

- Trader Web

- PU Sosial

-

- Kondisi Perdagangan

- Jenis Akun

- Spread, Biaya & Swap

- Setoran & Penarikan

- Biaya & Biaya

- Jam Perdagangan

Unduh Aplikasi

*Dollar consolidates near key range amid investor indecision

*U.S. government shutdown weigh on sentiment

*Delayed U.S. economic data adds uncertainty to Fed outlook

Market Summary:

Crude oil prices extended their decline last week, tumbling to multi-month lows as growing fears over the glThe U.S. Dollar Index (DXY) traded in a narrow range this week, hovering near key technical levels as investors weighed conflicting market signals. Persistent uncertainty over the U.S. fiscal situation and global risk sentiment kept traders cautious, limiting directional conviction for the greenback.

Earlier concerns over U.S. dollar debasement, which had driven investors toward cryptocurrencies, have begun to ease following last weekend’s sharp crypto selloff. While digital assets rebounded modestly afterward, the volatility prompted investors to reassess the narrative around dollar weakness. The DXY regained modest demand, though its long-term outlook remains tilted to the downside.

The ongoing U.S. government shutdown, now among the longest on record, has delayed the release of key economic indicators — including Nonfarm Payrolls and Unemployment Rate data. The absence of fresh economic figures has complicated the Federal Reserve’s policy assessment, while rate-cut expectations continue to linger, keeping medium-term pressure on the dollar.

On the supportive side, heightened U.S.–China trade tensions and political uncertainty in France have encouraged safe-haven demand for the dollar, cushioning its losses. Moving forward, traders will closely monitor developments surrounding the U.S. fiscal impasse and U.S.–China relations, both of which could dictate near-term direction for the greenback.

Technical Analysis

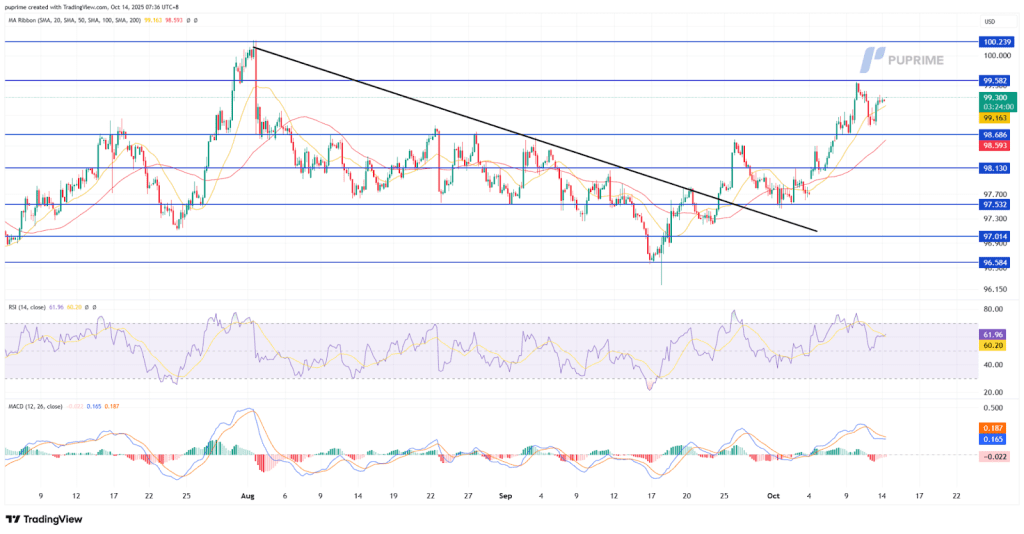

The Dollar Index is trading lower and currently testing the support level at 98.80, forming a potential double-top pattern. The MACD shows increasing bearish momentum, while the RSI has broken below the midline, standing near 43, suggesting a bias toward further downside.

A confirmed break below 98.80 could open the door for a move toward the next support at 98.15. However, if the index holds above this level, a rebound toward 99.55 remains possible.

Resistance Levels: 99.55, 100.25

Support Levels: 98.80, 98.15

Trading forex, indeks, Logam, dan lainnya dengan spread rendah di bidang ini dan eksekusi secepat kilat.

Daftar Akun Live PU Prime dengan prosedur kami yang tanpa ribet.

Danai akun Anda secara mudah dengan aneka ragam kanal pembayaran dan mata uang yang diterima.

Akses ratusan instrumen dalam kondisi trading terunggul di pasar.